Introduction

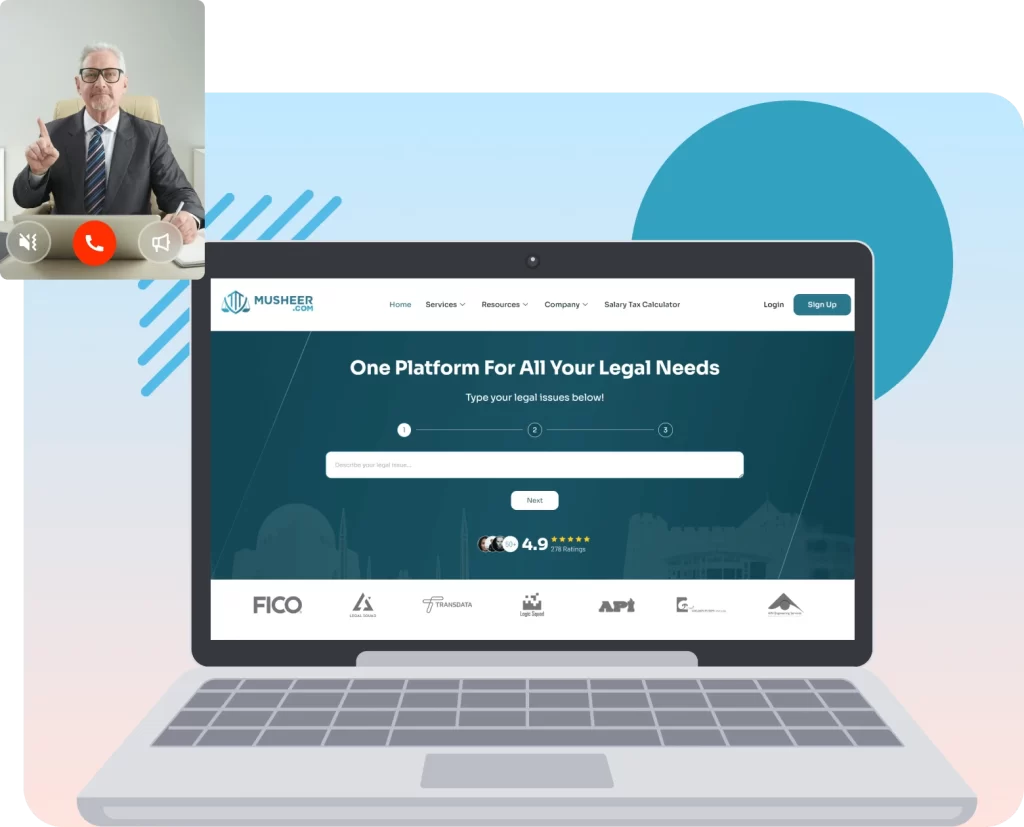

The introduction of the E-Stamp Paper system has revolutionized the process of stamp duty collection. This innovative digital approach has not only curbed revenue leakage caused by fake and fraudulent practices but also significantly improved the convenience and efficiency of stamp issuance. The e-stamping system, once a lengthy and cumbersome process taking several days, is now available online, allowing citizens to purchase high-value non-judicial and judicial stamp papers with ease. This article explores the various aspects and benefits of e-stamp paper in Pakistan.

Understanding E-Stamp Paper

An e-stamp paper is the electronic version of traditional physical stamp papers, designed for financial transactions and legal documents. Instead of using physical paper embossed with a government seal, the e-stamp paper is stored digitally, streamlining the payment process. Users have the option to either print the e-stamp paper or display it on a computer screen when required.

The Need for E-Stamp Paper in Pakistan

Before the introduction of the E-Stamp Paper system, the collection of stamp duty faced several challenges. Fake and fraudulent practices resulted in significant revenue losses for the government, while the cumbersome and time-consuming process inconvenienced citizens who often had to wait for two to three days for stamp issuance.

The Shift towards E-Stamping in Pakistan

The introduction of e-stamping in Pakistan aims to address issues related to counterfeit stamp papers and enhance the overall citizen experience. The E-Stamp Paper system brings a systematic approach to the calculation and issuance of stamp duty. To determine the value of the stamp duty, the buyer provides essential data, such as land area, location, covered area, and the commercial/residential status of the property. This data is then used in conjunction with the DC valuation tables, which have been integrated into the system. The information is verified, and the e-stamp paper is issued to the buyer.

Centralized Database and Verification Process

One of the most significant achievements of the E-Stamp Paper system is the establishment of a centralized database. This database houses all relevant information, making the verification process easier and more efficient for citizens.

Benefits of E-Stamp Paper System

- Convenience: The online availability of e-stamp papers has eliminated the need for citizens to visit physical stamp dealers. With just a computer and an internet connection, anyone can apply for and obtain e-stamp papers from the comfort of their home or office.

- Enhanced Security: The digital nature of e-stamp papers significantly reduces the risk of fraudulent practices. Electronic verification and authentication processes help ensure the authenticity of stamp papers, providing citizens with greater confidence in their transactions.

- Reduction in Corruption: By minimizing opportunities for counterfeiting, the E-Stamp Paper system plays a crucial role in curbing corruption related to stamp duty collection. This transparency promotes trust in the government and encourages a more ethical business environment.

E Stamp Paper implementation across Pakistan

E Stamp Paper in Punjab

The Government of Punjab, in collaboration with PITB and the Bank of Punjab (BOP), pioneered the e-stamping system in Pakistan in 2016. The system has been particularly beneficial in property-related transactions, simplifying the verification process and enhancing access to property rights, especially for women.

E Stamp Paper in Khyber Pakhtunkhwa (KPK)

In 2022, E-Stamp Paper system was introduced in KPK, extending the benefits of e-stamping to the province. With a simple online process and the provision of relevant data, citizens can obtain high-value non-judicial or judicial stamp papers conveniently.

E Stamp Paper in Sindh

Following the footsteps of Punjab and KPK, Sindh also successfully implemented its E-Stamp Paper system. Additionally, the reduction in stamp duty in the Province of Sindh from 2% to 1% is also a relief for the citizens of Sindh.

Services Offered at E-Stamp Portals

- Generation of a New Challan Form No. 32-A

- Payment of Deficient Capital Value Tax (CVT), Registration, or Comparison Fee

- Calculation of a Property’s Value as per Deputy Commissioner (DC) Rates

- Reprinting of an Existing Challan 32-A

- Payment of Deficient Stamp Duty or Penalty on e-Stamps

- Verification of e-Stamping Process Online

Conclusion

The implementation of the E-Stamp Paper system in Pakistan represents a significant milestone in the country's pursuit of modernizing government operations and enhancing citizen facilitation. The move from physical stamp papers to a digital platform has not only addressed revenue leakage and fraudulent practices but has also expedited the stamp issuance process and brought transparency to the system. With more regions adopting this transformative digital initiative, Pakistan is well on its way to creating an efficient, secure, and corruption-free stamp duty collection system, benefitting both the government and its citizens.